|

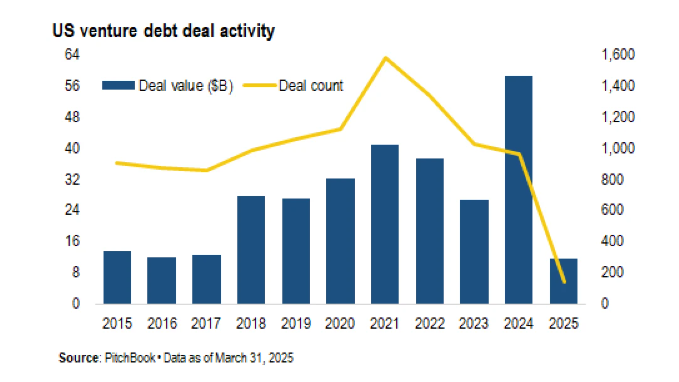

Silicon Valley Bank president Marc Cadieux says the venture debt market is increasingly seeing larger deals with thinner equity cushions, led by a pullback among Venture Capital investors. While venture deal activity slowed, debt issuance reached new heights in 2024, driven by large AI-related transactions. The venture debt market is increasingly seeing larger deals with thinner equity cushions, led by a pullback among venture capital investors, says Silicon Valley Bank president Marc Cadieux. Venture debt could help IPO hopefuls buy time, as it did during the COVID-19 market crash. Companies considering imminent listings would be likely candidates to take on loans to bridge the gap until their IPO. Venture capital has suffered in recent years amid a lack of exit opportunities — M&A is paltry, and recent tariff developments have created their own set of concerns stalling deal activity. While venture deal activity slowed, debt issuance reached new heights in 2024, particularly on the back of large AI-related transactions. Total venture debt volume reached $58.7 billion in 2024, more than double the $26.8 billion in 2023. In Q1 2025, lenders issued $11.6 billion in loans across 144 deals. Now a division of First Citizens Bank, SVB is a bank and venture lender. In March, the company announced a $2.5 billion venture debt “lending relationship” with Pinegrove Venture Partners. (Pinegrove had previously acquired SVB’s venture capital arm, SVB Capital, out of bankruptcy in 2024.) “Generally, the demand for venture debt has gone up as the availability of equity financing has gone down. In the ZIRP (zero interest-rate policy) era, for example, equity financing was so abundant and relatively inexpensive that we probably lost more deals to being crowded out by equity than we did to all of the other debt competitors combined. Now we’re in a really different part of the cycle, and that demand profile has shifted.” says Silicon Valley Bank president Marc Cadieux. Story by Sami Vukelj, who writes about direct lending and private credit markets for LCD. He joined PitchBook in 2025. For full story, click here.

0 Comments

The UK and the EU have outlined a “new strategic partnership” aimed at bolstering trade and presenting a united European front in Ukraine in defiance of Donald Trump’s threat to upend decades of transatlantic alignment. A draft declaration being drawn up by London and Brussels ahead of a UK-EU summit on 19 May points to a “common understanding” on a number of shared interests. EU ambassadors will meet in Brussels on Wednesday for a briefing from officials who have spent the past few months in a “tunnel” working on the areas where agreement could be reached over the next year. A defense and security pact that would see closer cooperation on Ukraine is top of the shopping list along with migration, which is a hot topic on both sides of the Channel. The French are determined to carve out new arrangements on fishing but diplomatic sources say there will be no change for the time being. the summit comes as the UK continues tariff negotiations with the US in the hope of carving out a special deal. Britain is facing a 10% tariff, while the EU faces 20%. Ahead of a meeting with the UK prime minister, Keir Starmer, last week, the leader of the European Commission, Ursula von der Leyen, called for a drive to unlock investment for renewables in the North Sea. “We are friends. And we are Europeans. It means that we share interests and democratic values. And that we are ready to face global challenges as like-minded partners,” von der Leyen said after their meeting. Downing Street declined to comment on the text but said it was in line with the UK’s objectives. Story by Lisa O'Carroll and Jessica Elgot

More than 2 million Californians are enrolled in Covered California, the state’s health insurance marketplace under the Affordable Care Act. Last year, some of these enrollees had their personal data shared with LinkedIn. Recent forensic testing by CalMatters’ Tomas Apodaca and Colin Lecher revealed that Covered California’s website has been sending sensitive data to the for-profit job recruiting social networking site — and that visitors could have had their data tracked for more than a year.  As visitors filled out forms on Covered California’s website, trackers sent information to Linkedin. The information included whether visitors were blind, pregnant or used a high number of prescription medications. The trackers also monitored whether visitors said they were transgender or possible victims of domestic abuse.

In a statement, a spokesperson for Covered California confirmed that data was sent to LinkedIn as part of an advertising campaign that began in February 2024. Since CalMatters and The Markup’s reporting about the issue, however, most, but not all, ad trackers have been removed from the site. Lawmakers from Japan's ruling party are pushing for the country's $1.8Trillion Government Pension Investment Fund (GPIF) to unleash capital for the domestic private market. This would not only likely benefit Japan Private Equity and Venture Capital industries, but it would also offer sought-after diversification for the national pension fund as the country faces down a demographic time bomb. The move is the latest in a long line of efforts to bolster the fund’s returns through alternatives exposure as Japan sits on a demographic time bomb. The Government Pension Fund of Japan, which manages the world’s largest pool of retirement savings, currently limits its alternatives exposure to around 5%, and only a fraction of that finds its way to private markets. However, Reuters now reports that members of Japan’s ruling party are pushing for the allocation to be increased to make more investments closer to home. The Private Equity industry in Japan has grown significantly in recent years, buoyed by corporate governance reform, a weaker yen, and by investment capital moving away from China. However, a large chunk of that investment comes via overseas investors. and last year, foreign investors accounted for 45% of Venture Capital deal value—the highest since 2015. Overseas participation in Private Equity has also grown for the fourth year in a row, with US firms such as Bain Capital, The Carlyle Group, and KKR routinely competing for the nation’s biggest buyouts. Notable deals include KKR’s $4.1 billion winning bid for Fuji Soft in February, and Bain’s $5.5 billion acquisition of Seven & i’s dining chain business. One of the lead lawmakers in the group calling on GPIF to bolster its PE and VC exposure is Fumiaki Kobayashi, who has outlined a raft of proposals on his website. In addition to diversifying GPIF’s alternatives exposure, he also suggested revising tax rules to incentivise more VC investment and revising the regulatory framework around LP structures to be accessible to overseas investors. National time bomb? There is a long way to go. As it stands, only around 1.65% of GPIF’s assets is in alternatives, which would also include hedge funds, infrastructure and real estate. The rest is evenly split between bonds and equities, with each split evenly between foreign and domestic. For GPIF, there is a strong incentive to diversify. Japan’s population is rapidly aging. According to government figures, the number of people age 65 and over hit a record high last year, reaching around 29.3% of the population. The OECD predicts this will reach 39% by 2060. This has meant that, simultaneously, more people are drawing on their savings while having fewer working-age people to make new contributions. This has put pressure on GPIF to bolster its returns by increasing its exposure to riskier assets. Story by Andrew Woodman, PitchBook’s London Bureau Chief and oversees news coverage of Europe and the Middle East.

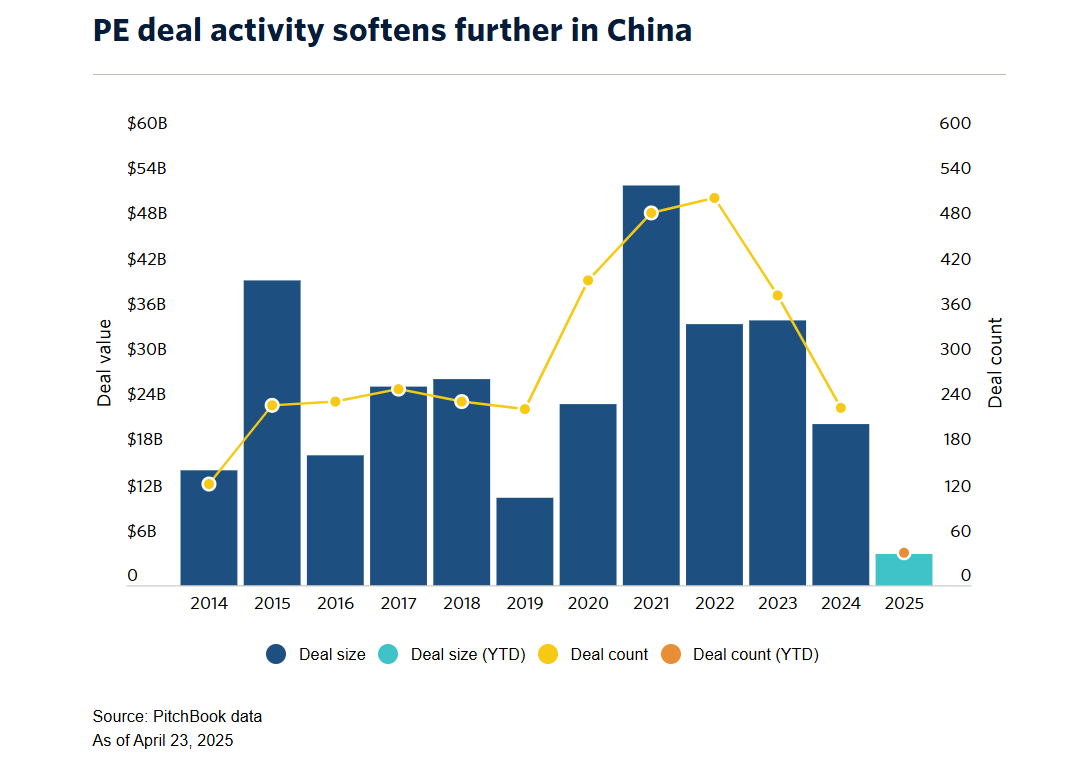

Permira is closing its Hong Kong and Shanghai offices to focus on high-growth opportunities in India. Global investors have cooled on China due to geopolitical risks and its slow economic recovery after COVID-19. The UK-based firm currently has five offices in APAC—Mumbai, Seoul and Singapore will remain after the Greater China offices close. According to the company’s website, it currently holds four investments in APAC, including China-based online commercial freight platform Full Truck Alliance, Hong Kong-based aquatic feed producer Grobest, Hong Kong-based aviation support services provider Topcast and Australia-based diagnostic imaging services provider I-Med Radiology Network. It will take around 18 months for the offices to wind down. rivate The Greater China office closure is part of Permira’s strategic shift to India. “When we look at the APAC region today, India stands out as the market where our platform has an edge. The combination of world-class talent, powerful consumption trends and a fast-growing cohort of digital-first businesses is well-aligned with Permira’s investing model,” Dipan Patel, co-CEO of Permira told PitchBook News. “We are focused on backing companies that are riding secular growth trends that are consistent with our transatlantic investment strategy—and India has an abundance of them.” The trade war between China and the US has brought added uncertainty to the Chinese Private Equity market, which has already seen its dominance diminish. Earlier this month, the US levied a 145% effective rate on Chinese goods, which led to China retaliating with a 125% tariff for US imports. As of April 23, US President Donald Trump said in the latest White House news conference that the tariffs on China will “come down substantially, but it won’t be zero”. It remains to be seen how much impact the tariff will have on China, which has already seen a significant slowdown in private market activities in the last three years. Private Equity deal value in China fell 40% year-over-year in 2024 to $21.4 billion, reaching only 40% of 2021’s peak. Deal activities slowed even further this year with only $4.2 billion transacted so far, accounting for around 20% of last year’s total. Story by Emily Lai, a London-based reporter for PitchBook covering private equity across Europe and the Middle East. For the full story, click here.

|

Mike townerOver 5 decades of trying to keep up with technology! ArchivesCategories

All

|

RSS Feed

RSS Feed