|

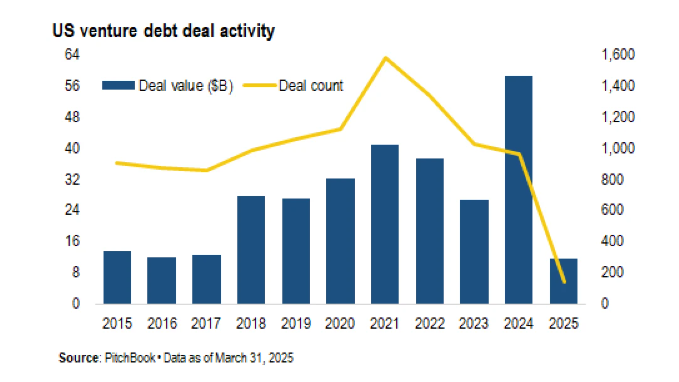

Silicon Valley Bank president Marc Cadieux says the venture debt market is increasingly seeing larger deals with thinner equity cushions, led by a pullback among Venture Capital investors. While venture deal activity slowed, debt issuance reached new heights in 2024, driven by large AI-related transactions. The venture debt market is increasingly seeing larger deals with thinner equity cushions, led by a pullback among venture capital investors, says Silicon Valley Bank president Marc Cadieux. Venture debt could help IPO hopefuls buy time, as it did during the COVID-19 market crash. Companies considering imminent listings would be likely candidates to take on loans to bridge the gap until their IPO. Venture capital has suffered in recent years amid a lack of exit opportunities — M&A is paltry, and recent tariff developments have created their own set of concerns stalling deal activity. While venture deal activity slowed, debt issuance reached new heights in 2024, particularly on the back of large AI-related transactions. Total venture debt volume reached $58.7 billion in 2024, more than double the $26.8 billion in 2023. In Q1 2025, lenders issued $11.6 billion in loans across 144 deals. Now a division of First Citizens Bank, SVB is a bank and venture lender. In March, the company announced a $2.5 billion venture debt “lending relationship” with Pinegrove Venture Partners. (Pinegrove had previously acquired SVB’s venture capital arm, SVB Capital, out of bankruptcy in 2024.) “Generally, the demand for venture debt has gone up as the availability of equity financing has gone down. In the ZIRP (zero interest-rate policy) era, for example, equity financing was so abundant and relatively inexpensive that we probably lost more deals to being crowded out by equity than we did to all of the other debt competitors combined. Now we’re in a really different part of the cycle, and that demand profile has shifted.” says Silicon Valley Bank president Marc Cadieux. Story by Sami Vukelj, who writes about direct lending and private credit markets for LCD. He joined PitchBook in 2025. For full story, click here.

0 Comments

|

Mike townerOver 5 decades of trying to keep up with technology! ArchivesCategories

All

|

RSS Feed

RSS Feed